Robust reforms and macro stability fuel optimism, but global tariff tensions remain the last hurdle.

India’s economic narrative today can be summed up as “The glass is almost full the rest is Trump Tariffs.”Despite global uncertainties, India has quietly laid down a strong foundation for sustained growth. A GDP growth rate of 7.8%, combined with a series of structural reforms like GST simplification, reduction in income tax, and steady control over inflation, has created an environment of confidence for businesses, investors, and consumers alike.

On the macroeconomic front, the country has benefited from lower crude oil prices, declining interest rates, and a favorable monsoon all of which are providing a positive boost to consumption and rural demand. These factors are not only stabilizing inflation but also setting the stage for robust long-term growth.

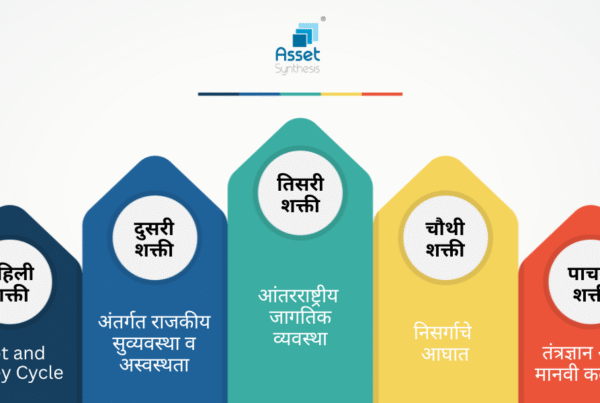

However, while the ground reality is overwhelmingly positive, market attention often shifts disproportionately to external risks such as tariff tensions triggered by the Trump administration’s policies. Such short-term global headwinds, though important, must be seen in perspective: they do not overshadow the structural tailwinds propelling India’s economy forward.

From an investment standpoint, this is an opportune phase. Long-term investors can take advantage of current market jitters by accumulating more units through SIPs or even lump sum investments. The strong domestic fundamentals, policy support, and reform momentum ensure that India’s equity story remains intact.

Additional Pointers: MSME and SME boost: The government’s focus on digitization, tax reliefs, and credit facilitation for small businesses is creating a more inclusive growth environment. Global investor confidence: India continues to attract foreign institutional flows, thanks to reforms that enhance ease of doing business.

Policy predictability: With fiscal consolidation and policy stability, India offers an anchor of growth in an otherwise volatile global economy.

Conclusion: While global tariffs may temporarily dominate headlines, the bigger picture is clear India’s growth story is strong, resilient, and nearly complete. For investors, staying patient and staying invested could be the key to unlocking this once-in-a-decade opportunity.