A ₹6-lakh-crore opportunity sails into view as India launches its boldest plan yet to reclaim maritime dominance through green ports, industrial linkages, and indigenous shipbuilding.

For a country that handles 95% of its trade by volume through the seas, India’s dependence on foreign ships costing nearly ₹6 lakh crore annually has long been a silent vulnerability. Now, the government is setting course for a transformation. Under the “Samudra Se Samriddhi” vision, Prime Minister Narendra Modi has unveiled an ambitious blueprint to make India a global maritime power through massive port infrastructure, renewable-powered shipping, and domestic fleet-building.

Anchoring Growth: A Maritime Infrastructure Overhaul The plan features a wave of new projects across India’s coastline: Container terminals at Kolkata and Paradip, and new cargo berths at Paradip and Tuna Tekra (Kandla). Sea-wall upgrades at Chennai Port and ship repair hubs in Patna and Varanasi to support inland waterways. The Mumbai International Cruise Terminal, set to redefine passenger sea travel. Together, these initiatives aim to expand cargo capacity, develop trade hubs, and integrate India more closely into global logistics routes marking a structural shift in how India moves goods and people.

Going Green at Sea

The maritime push also places sustainability at its core. Ports such as Deendayal (Kandla) will house a green bio-methanol plant, while the HPLNG terminal at Charra Port boosts cleaner fuel infrastructure. A 280 MW solar project and 600 MW “Green Shoe” initiative highlight the shift toward renewable-powered port operations. Inland, the PM-KUSUM solar programme with 475 MW capacity in Gujarat links farmers to the green energy grid. India’s ports are thus evolving not just as trade gateways but as carbon-light industrial ecosystems.

Public–Private Alliances at Work: The momentum extends to shipbuilding and fleet development. A joint venture between Cochin Shipyard and Korea’s HD KSOE will strengthen domestic ship design and manufacturing capabilities. Meanwhile, collaborations among SCI, BPCL, HPCL, and IOCL aim to aggregate vessel capacity for energy trade.

Major MoUs signed with Cochin Shipyard, GRSE, and Mazagon Dock will expand both defense and commercial shipbuilding. States like Andhra Pradesh, Odisha, Gujarat, Maharashtra, and Tamil Nadu are positioning themselves as regional shipbuilding clusters under the new maritime industrial policy.

Gujarat: India’s Maritime Vanguard: Gujarat remains the fulcrum of this push. Beyond its coastline, the state is steering toward a clean-energy future with 100% solarisation of Dhordo village, new academic and healthcare infrastructure in Jamnagar, Rajkot, and Surat, and a 45 MW Waste Land Solar Project. Together, these initiatives cement Gujarat’s position as India’s maritime and green energy hub. Sectors and Stocks to Watch: The maritime revival presents multi-sector investment opportunities

- Shipping & Offshore Operators: Shipping Corporation of India (SCI) and Great Eastern Shipping stand to gain from domestic fleet expansion and crude trade recovery. Essar Shipping, SEAMEC, and Global Offshore Services offer exposure to offshore and exploration-linked activity, though cyclical risks persist.

- Shipbuilders & Repair Yards: Cochin Shipyard, GRSE, and Mazagon Dock are key defense and commercial shipbuilders with healthy order books, supported by government capex.

- Ports & Logistics: Adani Ports & SEZ, JSW Infrastructure, and Gujarat Pipavav remain central to India’s port growth story, while Aegis Logistics, Gateway Distriparks, and Allcargo Terminals could benefit from LNG and container trade growth.

- Dredging & Marine Construction: Dredging Corporation of India is expected to gain from Sabarimala-linked port expansion and deep-draft projects.

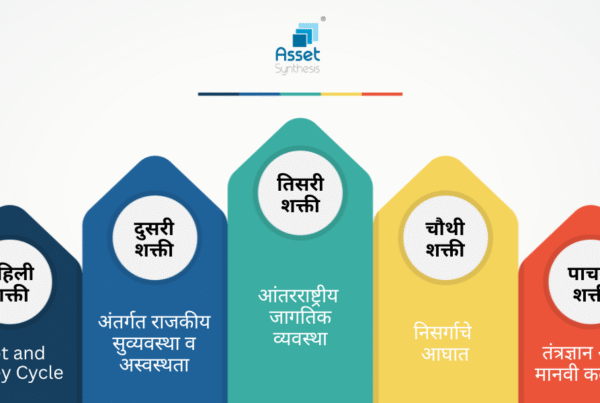

Winds in Favor and Headwinds Ahead

- Several structural drivers are aligned:

- Government focus on coastal shipping and inland waterways,

- Push for green fuels like methanol and LNG,

- Défense shipbuilding expansion, and

- Rising global freight rates boosting margins

Yet, challenges remain volatile global trade, PSU execution delays, capex-heavy balance sheets, and regulatory uncertainties around port pricing.

The Investment Tide: Despite these risks, India’s maritime sector remains under-owned yet full of latent potential. Even diverting 20% of cargo from foreign to Indian vessels could unlock ₹1 lakh crore in annual value, while creating jobs, driving exports, and improving logistics efficiency. If executed with discipline and speed, Samudra Se Samriddhi could do for maritime trade what the Golden Quadrilateral did for highways turning the seas into corridors of prosperity.